The Investment Wave Powering AI Robotics

In the past decade, robotics has shifted from being a futuristic concept to a central pillar of industrial, medical, and domestic innovation. What’s pushing this transformation into overdrive isn’t just technological breakthroughs, but a massive surge of funding—billions of dollars pouring in from both governments and private enterprises.

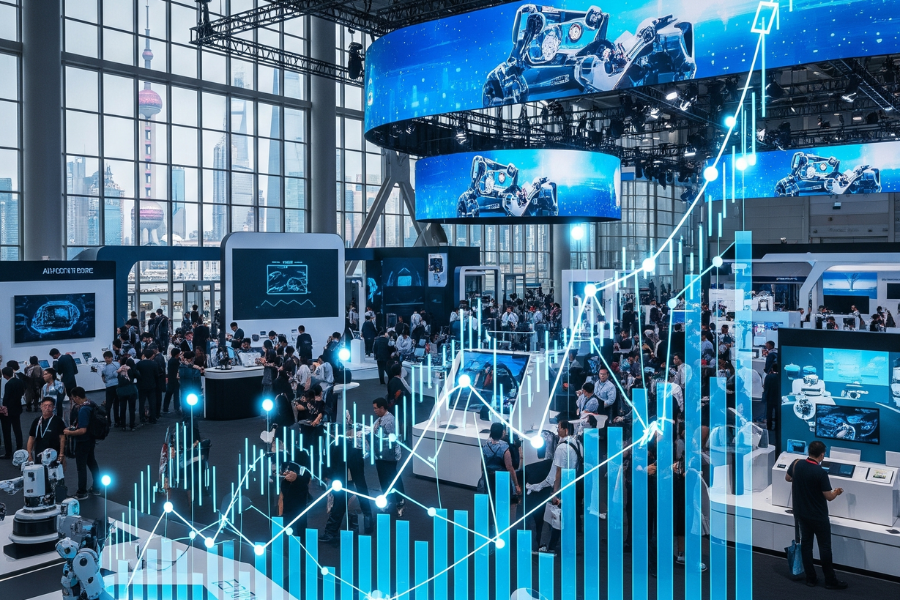

Nowhere is this more evident than in China, where robotics and AI investment have become national priorities. Supported by policies like Made in China 2025 and regional smart manufacturing zones, the country is seeing unprecedented capital flow into robotic startups and established players alike.

This funding surge is accelerating research, lowering production costs, and fueling global competition. From humanoid robots to healthcare assistants, the money trail reveals a race to dominate the AI-powered robotics era.

Public Funding: Governments Betting Big

China’s government has long identified robotics as a strategic technology sector. In 2024 alone, several provinces, including Guangdong, Zhejiang, and Shanghai, announced multi-billion yuan investment packages to boost robotics manufacturing capacity.

Key initiatives include:

Dedicated Robotics Industrial Parks with subsidized land and R&D centers.

Grants for Startups focusing on humanoids, collaborative robots, and AI automation.

Procurement Programs where government bodies deploy domestic robots in hospitals, schools, and factories, creating guaranteed demand.

This public backing not only supports innovation but also sends a powerful signal to private investors, making robotics a safer and more attractive bet.

Private Capital Races to Catch Up

At the same time, venture capital firms, corporate investors, and even tech giants are racing to fund the robotics wave. Chinese companies like Tencent, Alibaba, and Xiaomi have all taken stakes in AI robotics ventures. International venture funds are also pouring money into Chinese robotics firms, betting on their ability to scale faster and cheaper than Western rivals.

Unitree Robotics, known for affordable quadruped robots, recently closed multi-million-dollar rounds to expand global production.

Dobot, specializing in robotic arms for industry and healthcare, has secured funding from both domestic and foreign backers.

Midea, which entered robotics through partnerships, continues to increase R&D spending and acquisitions.

Private funding is particularly focused on application-driven robots—those that can quickly demonstrate real-world utility, from factory automation to elder care assistance.

Why Investors See Robotics as the Next Gold Rush

Investors aren’t just betting on hype; they’re looking at economic fundamentals:

Aging Workforce: With labor shortages hitting industries worldwide, robots are needed to keep production running.

Healthcare Crisis: Elder care robots offer solutions to the demographic challenges of aging societies.

AI Breakthroughs: Natural language processing and computer vision are making robots more intelligent and useful.

Global Supply Chains: Post-pandemic, companies are investing in automation to reduce reliance on fragile labor systems.

Export Potential: China’s low-cost robotics production positions it as a major exporter, similar to how it dominates solar panels and EV batteries.

For many investors, robotics is seen as the semiconductor boom of the 2020s—a once-in-a-generation opportunity.

Risks & Challenges

Still, the surge in funding comes with challenges. Not all startups will succeed, and overinvestment could lead to market bubbles. Some key concerns include:

Technology Gaps: While Chinese firms excel in cost efficiency, advanced robotics still lags behind Japan and Germany in precision engineering.

Data Security: With robots operating in sensitive areas like healthcare and defense, cybersecurity is a growing worry.

Regulatory Uncertainty: Governments are still debating ethical frameworks for robots in society.

Oversaturation: Too many companies chasing the same slice of the robotics market could thin out profits.

Investors are aware of these risks but believe the upside far outweighs them in the long run.

The Global Ripple Effect

China’s robotics funding surge is not happening in isolation—it’s reshaping global markets.

U.S. and European Firms are increasing R&D to compete with cheaper Chinese robots.

Japan and South Korea are doubling down on precision robotics, aiming to stay ahead in industrial automation.

Developing Nations may soon benefit from affordable Chinese robotics imports, leapfrogging into automation without heavy domestic R&D.

This competitive pressure ensures that innovation will only accelerate worldwide.

The Road Ahead: Sustainable Growth or Bubble?

Analysts predict that robotics will remain a top investment sector for at least the next decade. With billions already committed, the ecosystem has enough momentum to carry forward even if short-term corrections occur.

What will matter most is balance: ensuring that funding doesn’t just chase flashy humanoid prototypes but also supports practical, scalable applications that improve daily life.

If that balance is struck, the robotics fund surge could be remembered as the spark that propelled humanity into the era of intelligent machines.

Conclusion

From government-backed megaprojects to private venture bets, the Robotics Fund Surge represents one of the largest coordinated pushes in modern technology history. By fueling startups, scaling production, and pushing AI breakthroughs into real-world applications, these billions are laying the foundation for a robotic future.

China, at the forefront of this movement, is not just building robots—it’s building the financial and industrial infrastructure for an AI-powered society.

The world will be watching closely, because the way money flows today will define the machines that shape tomorrow.