Introduction

Finance is undergoing one of the most radical transformations in history, and at the center of this shift is Artificial Intelligence (AI). From digital lending to robo-advisors, AI is changing how people borrow, invest, and manage money.

Nowhere is this change more visible than in China, where companies like Ant Group (Alibaba’s fintech arm), Tencent, and Sesame Credit are deploying AI to reshape credit scoring, wealth management, and risk analysis.

This isn’t just about faster apps—it’s about redefining financial trust, democratizing credit, and making wealth services more accessible to millions.

The Evolution of Credit Scoring

Traditional credit systems—like FICO in the U.S.—depend heavily on a person’s borrowing history, bill payments, and bank records. However, these systems leave out huge populations with no prior credit footprint.

Enter AI-powered credit scoring, where algorithms use behavioral, transactional, and digital footprint data to assess a person’s trustworthiness.

In China, Sesame Credit, operated by Ant Group’s Alipay, goes beyond traditional models. It considers factors like:

Payment history (utility bills, online purchases, etc.)

Behavior & spending patterns

Network trust (associations with reliable or unreliable contacts)

Digital activity (app usage, e-commerce behavior)

This AI-based approach expands credit access to millions who would otherwise remain “unbanked.”

Sesame Credit: China’s AI Credit Pioneer

Launched in 2015, Sesame Credit quickly became one of the largest AI-driven scoring systems in the world. With over 900 million Alipay users, its algorithms assess real-time financial risk.

AI Predictive Modeling: Instead of just looking at past loans, Sesame Credit uses machine learning to forecast future financial behavior.

Inclusion for the Unbanked: Farmers, gig workers, and small entrepreneurs can gain credit access without traditional banking records.

Trust-Based Ecosystem: A higher score not only boosts loan approval chances but also unlocks perks like hotel check-ins without deposits and faster visa processing.

Sesame’s model demonstrates how AI isn’t just digitizing finance—it’s redefining financial identity.

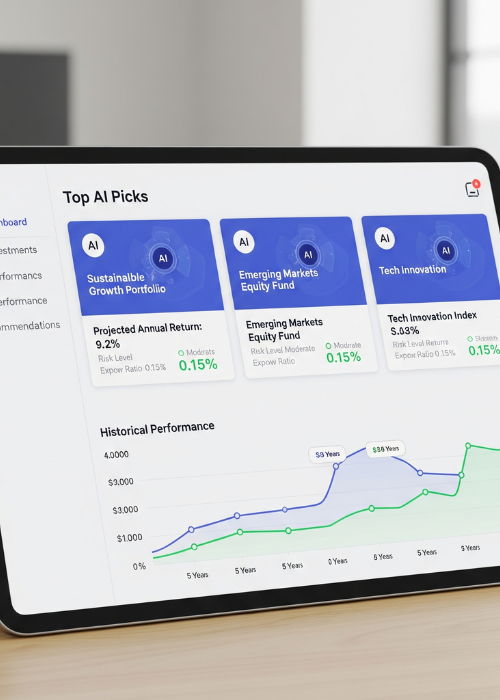

Ant Group’s Robo-Advisors: Wealth for Everyone

Ant Group, parent of Alipay and operator of Sesame Credit, has also ventured deep into AI-powered wealth management.

AI Robo-Advisors: Tools like Ant Fortune use AI to recommend personalized investment portfolios based on risk appetite, spending habits, and financial goals.

Micro-Investments: With as little as ¥1 (15 cents), anyone can start investing in AI-curated funds. This makes wealth-building accessible to even low-income users.

Risk Assessment: AI models constantly track global market trends and user activity to adjust investment strategies in real time.

This approach is especially powerful in China, where millions of first-time investors are entering financial markets. AI ensures these newcomers can make data-driven decisions without deep financial knowledge.

Tencent’s AI in Finance

While Ant Group dominates mobile payments and wealth services, Tencent (the parent of WeChat) has leveraged AI to integrate finance directly into daily life.

WeChat Pay Credit Services: Tencent uses AI-driven scoring to assess lending risk for microloans and small business financing.

AI Risk Control: Its fraud detection algorithms analyze billions of WeChat transactions to detect unusual activity in milliseconds.

Wealth Management Chatbots: Tencent’s apps feature AI assistants that guide users through investment options in natural language.

Tencent’s power lies in seamless integration—users don’t need to open a finance app; their financial ecosystem lives inside the same app they use for chatting, shopping, and entertainment.

Benefits of AI in Finance & Credit

Financial Inclusion

Millions without traditional credit histories now gain access to loans and investments.Efficiency & Speed

AI systems process applications in seconds, compared to days or weeks in traditional banks.Better Risk Management

Machine learning models detect fraud and reduce bad debt more effectively than human-led processes.Personalization

From robo-advisors to spending recommendations, AI tailors services to each user’s behavior.

Challenges & Concerns

Despite its benefits, AI-driven finance faces criticism and challenges:

Privacy Risks: Using social and behavioral data for credit scoring sparks debates about data rights.

Bias & Fairness: Algorithms may unintentionally penalize certain groups if the training data is skewed.

Over-Surveillance: Some worry that systems like Sesame Credit blur the line between financial trust and social control.

Regulatory Pressure: Chinese regulators have tightened rules around fintech, requiring transparency in AI credit scoring.

Global Implications

China’s AI-driven credit and finance systems are years ahead of many Western markets. Companies in Europe, Southeast Asia, and Africa are looking to replicate Ant Group’s and Tencent’s models to boost financial inclusion.

Even major global banks like JPMorgan and HSBC are experimenting with robo-advisors and AI credit risk tools, inspired partly by Chinese fintech innovation.

Conclusion

AI is not just changing the tools of finance—it is rewriting the rules of trust. With Sesame Credit, Ant Group, and Tencent at the forefront, China is showing how AI can democratize access, reduce inefficiencies, and make finance more inclusive.

However, the rapid pace of adoption also raises vital questions: Who controls the data? How do we prevent algorithmic bias? And how do we balance innovation with privacy?

The answers will define not just the future of finance in China, but the future of global financial ecosystems.

-Futurla